In an unpredictable market, many investors seek secure investments with guaranteed returns. Treasury bills issued by the U.S. government offer just that. This guide will walk you through buying treasury bills on Charles Schwab, highlighting key benefits, options, and considerations.

Discover the benefits, understand the risks, and unlock a secure investment approach. Learn how to buy Treasury Bills on Schwab today!

Benefits of Treasury Bills:

- Safety: Backed by the full faith and credit of the U.S. government, treasury bills are considered one of the safest investments available.

- Guaranteed Return: You receive the purchase price plus interest upon maturity, ensuring a predictable return.

- Liquidity: Most treasury bills mature within a year, offering short-term access to your funds.

- Interest Rates: Compared to savings accounts, treasury bills offer competitive interest rates, especially in periods of rising rates.

Understanding Yield Curves and Risks:

The inverted yield curve, where short-term rates are higher than long-term rates, has historically preceded recessions. However, past performance does not guarantee future results. While treasury bills are considered safe, there is always a risk of inflation eroding your purchasing power.

Buying T-Bills at Charles Schwab: A Step-by-Step Guide :

Looking for a safe and stable investment in a volatile market? Treasury bills (T-bills) might be the answer! This guide will walk you through buying Treasury Bills on Charles Schwab, step-by-step.

Before you begin:

- Make sure you have a Charles Schwab account and are logged in.

- Understand that T-bills have minimum investment amounts ($100 on Treasury Direct, $1,000 at Schwab).

Steps to how to buy treasury bills on Schwab

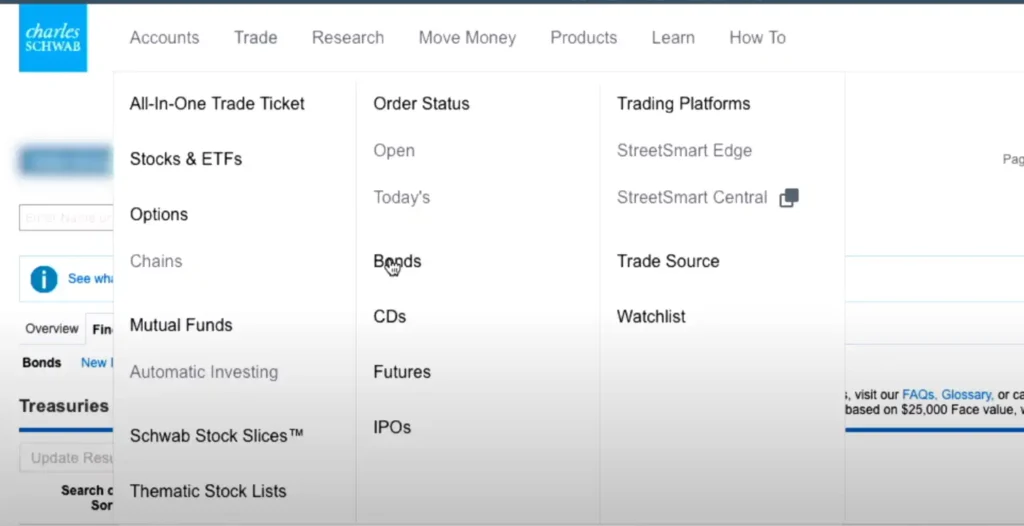

Step 1: Navigate to the Trade section:

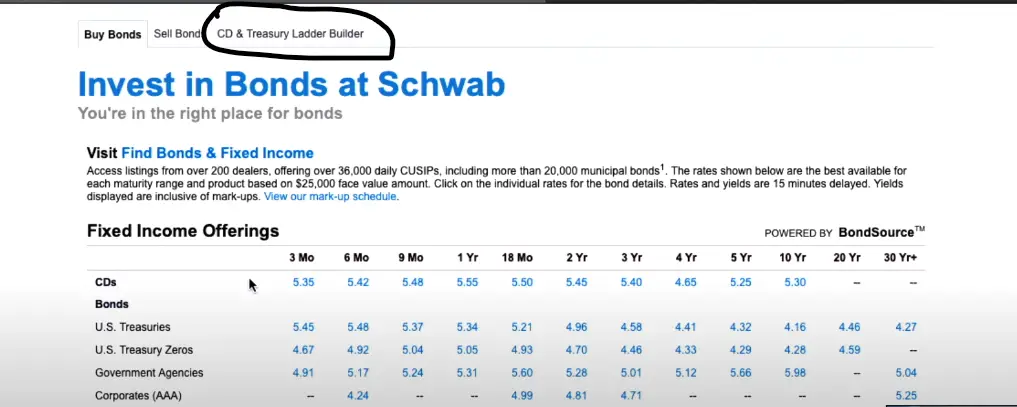

Step 2: Locate Treasury auctions:

Step 3: Choose your T-bill:

- Auction date: Make sure to place your order at least a day before the auction.

- Maturity date: This is when you’ll receive your investment back plus interest. Pick the maturity date that suits your needs.

- Minimum increment: Each T-bill share represents a specific dollar amount (e.g., $11,000 at Schwab).

Step 4: Place your order:

- Select the desired Treasury Bills and click “Buy.”

- Enter the number of shares you want to purchase (based on the minimum increment).

Review the order details:

- Verify the maturity date.

- Choose “Auto Rollover” if you want Schwab to reinvest your maturing Treasury Bills automatically.

- Understand that “Market order” is the default, guaranteeing execution but not a specific price.

Step 5: Finalize your purchase:

Important Considerations:

- Early withdrawals may incur penalties.

- Plan to ensure access to funds if needed.

- Consider your investment goals and risk tolerance.

Additional Options:

- Charles Schwab offers longer-term treasury notes and bonds for higher potential returns.

- Seek assistance from the fixed income department or a broker for personalized guidance.

Conclusion

Investing in treasury bills on Charles Schwab provides a safe and convenient way to earn guaranteed returns. Consider your investment goals, risk tolerance, and market conditions before making decisions.

Disclaimer: This information is for educational purposes only and should not be considered financial advice. Please consult with a qualified financial advisor before making any investment decisions.