We often hear about investment fintechzoom on the internet and news. But first of all, you need to know what is Fintech, then only you can understand what is fintech zoom and its benefits to society.

Table of Contents

Fintech Explained: What You Need to Know

Fintech, short for financial technology, refers to the application of technology to improve and automate financial services. Fintech is a term that encompasses a wide range of financial activities, including mobile banking and digital wallets. cryptocurrency and more. Fintech companies leverage technology to offer more efficient and convenient financial services to their customers.

Fintech is revolutionizing the financial industry and disrupting traditional financial systems. Banks are facing competition from fintech companies that offer better rates and a more personalized customer experience. Fintech is also changing the way we think about money and finance with new products and services that are designed to make managing our finances more convenient.

In conclusion, fintech is an exciting and innovative industry that’s changing the way we manage our finances. So now we will know how to grow Investment FintechZoom in our portfolio.

Introducing Fintech Zoom: Your Investment Platform

FintechZoom is a good Fintech Information publishing platform headquartered in the United Kingdom. It was founded in May 2016 to inform, educate, and connect the global financial community through news, research, events, and training. FintechZoom’s reach extends to hundreds of thousands interested in digital assets and blockchain technology.

Fintech Zoom Significance in the Finance Sector:

- FintechZoom is vital in providing up-to-date and accurate information about the rapidly evolving Fintech industry.

- It helps to connect Fintech startups and entrepreneurs with investors and potential customers.

- FintechZoom’s research and analysis help to shape the future of the Fintech industry.

| Location | United Kingdom |

| Establishment | May, 2016 |

| Founders | Not specified |

| Field of work | Fintech Information (Stock Market, Investments, Personal Finances, Cryptocurrency, Blockchain, Regulation, Money, and Banking) |

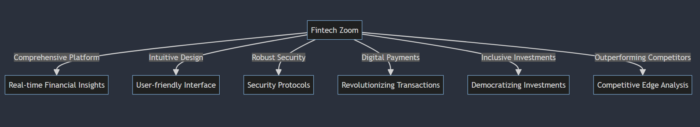

Fintech Zoom’s Edge: Features That Set Us Apart

Some Core features of Fintechzoom set it apart from its competitors.

- Advanced Analytics and Data Integration: See the whole picture, Advanced analytics and data mashups give you in-depth insights into market trends

- Personalized Investment Strategies: Invest smarter, not harder. Get personalized investment plans based on your goals and risk tolerance.

- Real-time Market Monitoring: Stay ahead of the curve, React instantly to market changes with real-time monitoring tools.

- User-Friendly Interface and Accessibility: Easy for everyone, an Intuitive interface makes managing money a breeze, for beginners and pros alike.

- Diversified Investment Options: Choose from stocks, crypto, and more to build a portfolio that matches your goals and risk tolerance.

- AI-driven Robo-Advisory Services: Robo-advisor uses smart tech to suggest investments and keep your strategy on track

- Transparent Fee Structure: Transparent pricing lets you know exactly what you’re paying.

- Educational Resources and Tools: Built-in resources help you understand your investments and make smarter decisions.

- Security Measures: Top-notch security protects your data and keeps your investments secure.

By combining these core features, Fintech Zoom sets itself apart from competitors in the fintech space, offering a holistic and innovative approach to investment that redefines traditional methods.

Fintech Zoom by the Numbers: User Stats Revealed

According to Fintech Zoom’s website, we have created a Table for you.

| Visitors | 2.17 Million per Month |

| World Category Rank | 5700 World Finance Rank |

| US Rank | 490k US Rank |

| Average Visit Duration | 02:26 Minutes |

| Traffic by Top 5 Country | United States – 46.6% United Kingdom – 6.76% Canada – 4.08% Australia – 3.26% Philippines – 3.23% |

| Audience Interests | Average Age – 41 Male/Female: 76%/24% (average of last 6 months). |

| Main Topics | Banking, Markets, Money, Investing, Cryptocurrencies, Luxury, Lifestyle |

Fintech Zoom: More Than Information, A Financial Future

FintechZoom is more than just an information hub; it’s a catalyst for the ever-evolving Fintech world. It empowers individuals with advanced tools, connects the global community, and actively shapes the industry’s future. Through insightful analysis, diverse investment options, and AI-driven support.

FintechZoom redefines financial management for a tech-savvy generation. This platform of 2.17 million users, predominantly male with an average age of 41, is not just deciphering the “Fintech enigma”; it’s building a more accessible, informed, and innovative future for finance.

Investment FintechZoom FAQs: Unveiling the Mysteries

What is Fintech, and how is it revolutionizing finance?

Answer: Fintech, short for financial technology, leverages technology to enhance and automate financial services. It encompasses various activities, including mobile banking, digital wallets, and cryptocurrency. Fintech companies use technology to offer more efficient and convenient financial services, disrupting traditional systems and changing how we manage finances.

What is the significance of FintechZoom in the finance sector?

Answer: FintechZoom is a crucial information platform providing up-to-date insights into the rapidly evolving Fintech industry. It connects startups, entrepreneurs, investors, and customers, shaping the industry’s future through research and analysis.

What sets FintechZoom apart from competitors?

Answer: FintechZoom stands out with advanced analytics, personalized investment strategies, real-time market monitoring, a user-friendly interface, diversified investment options, AI-driven robo-advisory services, transparent fee structures, educational resources, and robust security measures.

How does FintechZoom contribute to the Fintech industry’s future?

Answer: FintechZoom actively contributes to the Fintech industry’s future by empowering individuals with advanced tools, connecting the global community, offering diverse investment options, and providing AI-driven support.

Is FintechZoom just an information hub, or does it offer practical tools?

Answer: FintechZoom is more than an information hub; it’s a practical catalyst for the Fintech world. It offers advanced tools, diverse investment options, insightful analysis, and AI-driven support, actively shaping a more accessible and innovative future for finance.