For the first time in almost a decade, you can earn meaningful interest on low-risk investments, thanks to high-interest rates. Recently, I invested some cash I had on the sideline with a 5.48% annualized return. In this article, we are going to tell you about treasury bills or T-bills and the top five reasons for buying them.

what is T- bills or Treasury Bills?

There are debts issued by the US Treasury, and you are essentially loaning money to the US government for the duration of the security.

There are three forms of debt offerings.

- Type: Long-term debts

- Maturity: 20 or 30 years

- Features:

- Issued for financing long-term projects or liabilities

- Fixed interest payments every six months

- Higher interest rates compared to shorter-term securities

- Purpose: Attract investors seeking stable, long-term investment options

- Type: Medium-term debt

- Maturity: 2 to 10 years

- Features:

- Used for medium-term borrowing needs

- Interest payments every six months

- Offers flexibility in balancing risk and return

- Purpose: Fund government spending and finance initiatives

- Type: Short-term debts

- Maturity: 4 weeks to 1 year

- Features:

- Shortest-term Treasury securities

- Sold at a discount, redeemed at face value upon maturity

- Typically issued in 4-week, 13-week, 26-week, and 52-week terms

- Purpose: Manage short-term liquidity needs and finance the government’s immediate expenses

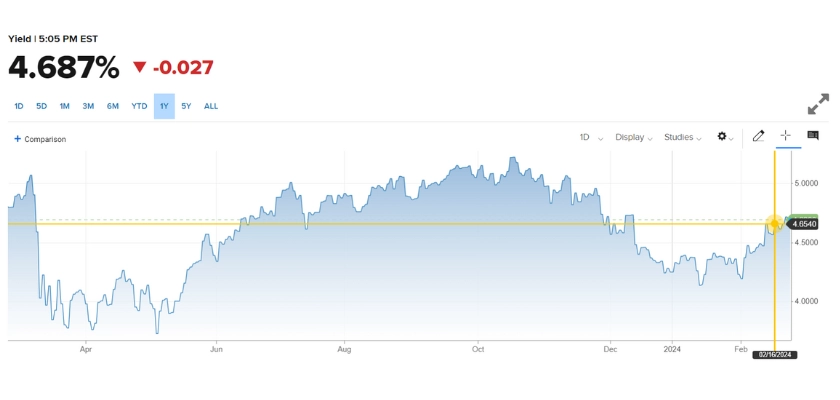

Right now, with the inverted year curve, short-term interest rates exceed long-term rates, therefore making the short-term Treasury Bills even more attractive.

You can see from the most recent auction results that the short-term T-Bill is getting much higher rates than the long-term notes in bonds.

| Security Term | CUSIP | Issue Date | Maturity Date | High Rate | Investment Rate |

|---|---|---|---|---|---|

| 4-Week | 912797JK4 | 02/27/2024 | 03/26/2024 | 5.29% | 5.40% |

| 8-Week | 912797JP3 | 02/27/2024 | 04/23/2024 | 5.28% | 5.41% |

| 17-Week | 912797KG1 | 02/27/2024 | 06/25/2024 | 5.22% | 5.40% |

| 13-Week | 912797HR1 | 02/22/2024 | 05/23/2024 | 5.23% | 5.39% |

| 26-Week | 912797KC0 | 02/22/2024 | 08/22/2024 | 5.10% | 5.32% |

| 52-Week | 912797KA4 | 02/22/2024 | 02/20/2025 | 4.70% | 4.95% |

| 4-Week | 912797JJ7 | 02/20/2024 | 03/19/2024 | 5.28% | 5.39% |

| 8-Week | 912797JN8 | 02/20/2024 | 04/16/2024 | 5.27% | 5.40% |

| 17-Week | 912797KF3 | 02/20/2024 | 06/18/2024 | 5.22% | 5.40% |

| 13-Week | 912797FH5 | 02/15/2024 | 05/16/2024 | 5.23% | 5.39% |

| 26-Week | 912797KB2 | 02/15/2024 | 08/15/2024 | 5.07% | 5.29% |

| 4-Week | 912797JH1 | 02/13/2024 | 03/12/2024 | 5.28% | 5.39% |

| 8-Week | 912797JM0 | 02/13/2024 | 04/09/2024 | 5.27% | 5.40% |

| 17-Week | 912797KE6 | 02/13/2024 | 06/11/2024 | 5.18% | 5.36% |

| 13-Week | 912797HQ3 | 02/08/2024 | 05/09/2024 | 5.24% | 5.39% |

| 26-Week | 912797GK7 | 02/08/2024 | 08/08/2024 | 5.05% | 5.26% |

| 4-Week | 912797JG3 | 02/06/2024 | 03/05/2024 | 5.28% | 5.39% |

| 8-Week | 912797JL2 | 02/06/2024 | 04/02/2024 | 5.27% | 5.40% |

| 17-Week | 912797JZ1 | 02/06/2024 | 06/04/2024 | 5.15% | 5.33% |

| 13-Week | 912797HH3 | 02/01/2024 | 05/02/2024 | 5.21% | 5.37% |

| Security Term | CUSIP | Issue Date | Maturity Date | High Rate | Investment Rate |

|---|---|---|---|---|---|

| 42-Day | 912797GZ4 | 02/22/2024 | 04/04/2024 | 5.28% | 5.40% |

| 42-Day | 912797GY7 | 02/15/2024 | 03/28/2024 | 5.28% | 5.40% |

| 42-Day | 912797LL9 | 02/08/2024 | 03/21/2024 | 5.28% | 5.40% |

| 42-Day | 912797GX9 | 02/01/2024 | 03/14/2024 | 5.28% | 5.40% |

| 42-Day | 912797GQ4 | 01/25/2024 | 03/07/2024 | 5.28% | 5.40% |

| 42-Day | 912797GP6 | 01/18/2024 | 02/29/2024 | 5.29% | 5.41% |

| Security Term | CUSIP | Reopening | Issue Date | Maturity Date | High Yield | Interest Rate |

|---|---|---|---|---|---|---|

| 10-Year | 91282CJZ5 | No | 02/15/2024 | 02/15/2034 | 4.09% | 4.00% |

| 3-Year | 91282CKA8 | No | 02/15/2024 | 02/15/2027 | 4.17% | 4.13% |

| 7-Year | 91282CJX0 | No | 01/31/2024 | 01/31/2031 | 4.11% | 4.00% |

| 5-Year | 91282CJW2 | No | 01/31/2024 | 01/31/2029 | 4.06% | 4.00% |

| 2-Year | 91282CJV4 | No | 01/31/2024 | 01/31/2026 | 4.37% | 4.25% |

| 10-Year | 91282CJJ1 | Yes | 01/16/2024 | 11/15/2033 | 4.02% | 4.50% |

| 3-Year | 91282CJT9 | No | 01/16/2024 | 01/15/2027 | 4.11% | 4.00% |

| 7-Year | 91282CJQ5 | No | 01/02/2024 | 12/31/2030 | 3.86% | 3.75% |

| 5-Year | 91282CJR3 | No | 01/02/2024 | 12/31/2028 | 3.80% | 3.75% |

| 2-Year | 91282CJS1 | No | 01/02/2024 | 12/31/2025 | 4.31% | 4.25% |

| 3-Year | 91282CJP7 | No | 12/15/2023 | 12/15/2026 | 4.49% | 4.38% |

| 10-Year | 91282CJJ1 | Yes | 12/15/2023 | 11/15/2033 | 4.30% | 4.50% |

| 7-Year | 91282CJM4 | No | 11/30/2023 | 11/30/2030 | 4.40% | 4.38% |

| 2-Year | 91282CJL6 | No | 11/30/2023 | 11/30/2025 | 4.89% | 4.88% |

| 5-Year | 91282CJN2 | No | 11/30/2023 | 11/30/2028 | 4.42% | 4.38% |

| 10-Year | 91282CJJ1 | No | 11/15/2023 | 11/15/2033 | 4.52% | 4.50% |

| 3-Year | 91282CJK8 | No | 11/15/2023 | 11/15/2026 | 4.70% | 4.63% |

| 7-Year | 91282CJG7 | No | 10/31/2023 | 10/31/2030 | 4.91% | 4.88% |

| 5-Year | 91282CJF9 | No | 10/31/2023 | 10/31/2028 | 4.90% | 4.88% |

| 2-Year | 91282CJE2 | No | 10/31/2023 | 10/31/2025 | 5.06% | 5.00% |

| Security Term | CUSIP | Reopening | Issue Date | Maturity Date | High Yield | Interest Rate |

|---|---|---|---|---|---|---|

| 20-Year | 912810TZ1 | No | 02/29/2024 | 02/15/2044 | 4.60% | 4.50% |

| 30-Year | 912810TX6 | No | 02/15/2024 | 02/15/2054 | 4.36% | 4.25% |

| 20-Year | 912810TW8 | Yes | 01/31/2024 | 11/15/2043 | 4.42% | 4.75% |

| 30-Year | 912810TV0 | Yes | 01/16/2024 | 11/15/2053 | 4.23% | 4.75% |

| 20-Year | 912810TW8 | Yes | 01/02/2024 | 11/15/2043 | 4.21% | 4.75% |

| 30-Year | 912810TV0 | Yes | 12/15/2023 | 11/15/2053 | 4.34% | 4.75% |

| 20-Year | 912810TW8 | No | 11/30/2023 | 11/15/2043 | 4.78% | 4.75% |

| 30-Year | 912810TV0 | No | 11/15/2023 | 11/15/2053 | 4.77% | 4.75% |

| 20-Year | 912810TU2 | Yes | 10/31/2023 | 08/15/2043 | 5.25% | 4.38% |

| 30-Year | 912810TT5 | Yes | 10/16/2023 | 08/15/2053 | 4.84% | 4.13% |

| 20-Year | 912810TU2 | Yes | 10/02/2023 | 08/15/2043 | 4.59% | 4.38% |

| 30-Year | 912810TT5 | Yes | 09/15/2023 | 08/15/2053 | 4.35% | 4.13% |

| 20-Year | 912810TU2 | No | 08/31/2023 | 08/15/2043 | 4.50% | 4.38% |

| 30-Year | 912810TT5 | No | 08/15/2023 | 08/15/2053 | 4.19% | 4.13% |

| 20-Year | 912810TS7 | Yes | 07/31/2023 | 05/15/2043 | 4.04% | 3.88% |

| 30-Year | 912810TR9 | Yes | 07/17/2023 | 05/15/2053 | 3.91% | 3.63% |

| 20-Year | 912810TS7 | Yes | 06/30/2023 | 05/15/2043 | 4.01% | 3.88% |

| 30-Year | 912810TR9 | Yes | 06/15/2023 | 05/15/2053 | 3.91% | 3.63% |

| 20-Year | 912810TS7 | No | 05/31/2023 | 05/15/2043 | 3.95% | 3.88% |

| 30-Year | 912810TR9 | No | 05/15/2023 | 05/15/2053 | 3.74% | 3.63% |

| Security Term | CUSIP | Reopening | Issue | Maturity Date | High | Spread | Discount Margin |

|---|---|---|---|---|---|---|---|

| 2-Year | 91282CJU6 | Yes | 02/23/2024 | 01/31/2026 | 0.20% | 0.25% | |

| 2-Year | 91282CJU6 | No | 01/31/2024 | 01/31/2026 | 0.25% | 0.25% | |

| 2-Year | 91282CJD4 | Yes | 12/29/2023 | 10/31/2025 | 0.25% | 0.17% | |

| 2-Year | 91282CJD4 | Yes | 11/24/2023 | 10/31/2025 | 0.20% | 0.17% | |

| 2-Year | 91282CJD4 | No | 10/31/2023 | 10/31/2025 | 0.17% | 0.17% | |

| 2-Year | 91282CHS3 | Yes | 09/29/2023 | 07/31/2025 | 0.18% | 0.13% | |

| 2-Year | 91282CHS3 | Yes | 08/25/2023 | 07/31/2025 | 0.17% | 0.13% | |

| 2-Year | 91282CHS3 | No | 07/31/2023 | 07/31/2025 | 0.13% | 0.13% | |

| 2-Year | 91282CGY1 | Yes | 06/30/2023 | 04/30/2025 | 0.13% | 0.17% | |

| 2-Year | 91282CGY1 | Yes | 05/26/2023 | 04/30/2025 | 0.17% | 0.17% | |

| 2-Year | 91282CGY1 | No | 05/01/2023 | 04/30/2025 | 0.17% | 0.17% | |

| 2-Year | 91282CGF2 | Yes | 03/31/2023 | 01/31/2025 | 0.19% | 0.20% | |

| 2-Year | 91282CGF2 | Yes | 02/24/2023 | 01/31/2025 | 0.16% | 0.20% | |

| 2-Year | 91282CGF2 | No | 01/31/2023 | 01/31/2025 | 0.20% | 0.20% | |

| 2-Year | 91282CFS5 | Yes | 12/30/2022 | 10/31/2024 | 0.24% | 0.14% | |

| 2-Year | 91282CFS5 | Yes | 11/25/2022 | 10/31/2024 | 0.22% | 0.14% | |

| 2-Year | 91282CFS5 | No | 10/31/2022 | 10/31/2024 | 0.14% | 0.14% | |

| 2-Year | 91282CFD8 | Yes | 09/30/2022 | 07/31/2024 | 0.09% | 0.04% | |

| 2-Year | 91282CFD8 | Yes | 08/26/2022 | 07/31/2024 | 0.09% | 0.04% | |

| 2-Year | 91282CFD8 | No | 08/01/2022 | 07/31/2024 | 0.04% | 0.04% |

Reasons to Consider T-Bills

risk-free:

Mainly they’re risk-free, Treasury bills are considered one of the safest investments because they are issued by the US Treasury. Unless there is a total collapse of the US government, your money is safe.

liquidity:

T- bills also provide liquidity. It can be sold in the secondary market if needed; however, selling before maturity may result in a loss if interest rates have risen since your purchase.

Higher Rates:

Treasury Bills or T-Bills typically pay higher rates than most high-yield savings accounts. According to Nerd Wallet, the best high-yield savings account ranges from 4.35 to 5.05% API. The newly issued weak T-Bill yields 5.41 18% API.

Low cost to start:

Another great advantage is that it’s low cost to start. You can start investing in bills with as little as $100 and up to $10 million.

Tax advantages:

Holding T-bills also has some tax advantages; all the interest earned from Treasury Bills is exempted from local or state income tax. Here in California, income tax can go as high as 12.3%, depending on your income level.

The unique aspect of T bills is how they are priced and structured; unlike a CD or a savings account where you receive periodic interest payments, T-bill interest is paid at maturity.

T-bills are sold at a discount to their face value. The difference between the discounted value and the face value at maturity is the interest earned.

How to buy T-Bills

You can buy either new issues of T-bills at auction or in the secondary market; the price of T-bills in the secondary market can fluctuate based on the changing interest rate. You may incur fees or commissions depending on the trading platform.

Typically, new issues of T-bills give better pricing, so that’s what we will focus on in this article; the US Treasury auctions new issues of T-bills every week except for the 52 Week T-bill, which is offered monthly.

Treasury Direct has a list of tentative auction schedules on its website . The announcement date is the date when the government formally announces the details of an upcoming auction. The auction date is the date on which bids are submitted to buy the offered treasure Securities.

To make a purchase of a Treasury Bills, you must place your purchase the night before the auction date; the settlement date is when the purchased Securities are delivered to the winning bidders, and the payment is made by the buyers to the government. Don’t feel intimidated by the war auction. This simply means you place a non-competitive bid where you agree to accept whatever yield is determined at the auction.

When you submit a buy order, you won’t know the actual yield until after the auction is done. T bill rates change from auction to auction, so you’re not guaranteed the same rate, but they’re not likely to change that much in a week, so you can get an idea of the rates you can potentially receive.

How to find recent auction results

Treasury Direct has a list of the latest auction results on its website. Look up the most recent auction for the duration you are interested in. The investment rate on the far-right column is the yield you would have received if you had bought t- T-bills at this auction.

To buyTreasury Bills, you can purchase directly from the US government using the treasury’s direct website or through your stockbroker like Charles Schwab.

Note: before you make the investment, make sure you choose the term that you can hold to maturity; otherwise, if you need to liquidate for cash, you may end up selling at a loss in the secondary market if interest rates have risen since your purchase.

What is the minimum purchase amount for T-Bills or Treasury Bills?

The minimum purchase on Treasury direct is $100, for most stock brokerages the minimum is 1000$, there are no fees when it comes to buying Treasury Bills with either Treasury Direct or online brokerages if you place your orders online.

If you prefer to buy your T bills through Treasury Direct, you will need some patience. The website is outdated, and it could be very frustrating to navigate the Treasury Direct website.

If You want to Know how to buy T-Bills, Bonds or FNPs on Charles Schwab Platform then you can check our guide

Additional notes:

- Consider the current market conditions and your investment goals before buying Treasury Bills.

- While Treasury Bills are safe, they offer lower returns than other investments.

- This guide offers a general overview. Consult with a financial advisor for personalized advice.