In a world where financial literacy plays an essential role in achieving financial goal, books stand as timeless inspirations guiding individuals to financial success.

This article aims to spotlight the top 5 Best Books on Personal Finance that have proven helpful in shaping financial mindsets and promoting economic wealth.

Table of Contents

The Richest Man in Babylon by George S. Clason Classics

Imagine ancient Babylon, not active with warriors, but with financial mysteries! “The Richest Man in Babylon” solves these secrets through engaging stories. Meet Arkad, a scribe who went from very poor to very rich. He shares “Seven Cures” to earn wealth, like saving a tenth of your income and investing intelligently.

You’ll learn how to build a rich purse, keep it safe, and make it work for you. Think of it as timeless financial wisdom disguised as an adventure across 4,000 long years. Definitely read it to solve your own inner “richest man” and turn financial dreams into reality.

We recommend this because

- Simple however powerful financial advice: The stories make difficult financial concepts easy to understand and remember.

- Timeless values: While set in ancient Babylon, the lessons apply to our modern world as well.

- Motivational and inspiring: Reading about Arkad’s journey can encourage you to achieve your own financial goals in real world.

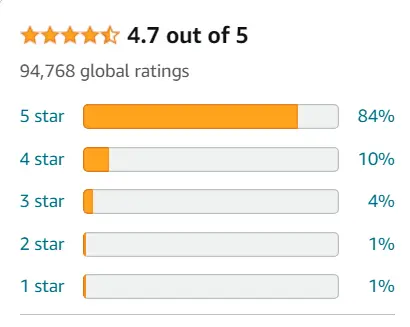

Ratings and Reviews:

Rich Dad Poor Dad by Robert T. Kiyosaki (Author)

Rich Dad Poor Dad isn’t about who has the most money, but how they think about it. Through two father figures, one educated but broke, the other self-made millionaire.

You learn key lessons like work for wealth, not money. assets put money in your pocket and liabilities take it out, financial IQ is a key, not just book smarts. It won’t guarantee riches, but it’ll spark a new thought process about your financial ride. This book is one of the top recommended books in our Top 5 Best Books on Personal Finance.

We recommend this because

- New Money Mindset: Dump trading time for money, learn to build assets that work for you.

- Practical Tools: Discover simple strategies for investing, income streams, and breaking free from debt.

- Motivation and Inspiration: The success story of the “Rich Dad” serves as a motivating example, encouraging readers to believe in their financial potential and follow their own path to wealth creation. The book’s positive and supporting tone can inspire action and sustained effort towards financial goals.

Ratings and Reviews:

The Intelligent Investor By Benjamin Graham (Author)

The Intelligent Investor teaches you to be a patient, value-minded investor, ignoring market urges and buying strong companies for less than they’re worth. Imagine finding $20 billions on the walkway, that’s the joy of value investing.

I read it to build a strong, long-term portfolio and avoid emotional rollercoasters in the market. It’s a classic book for a reason, timeless wisdom stored with practical advice. Warren Buffett, one of the world’s most successful investors, calls “The Intelligent Investor” the “best book about investing ever written. That is why, we recommend this book as one of the best books on personal finance and investing.

Ratings and Reviews:

Just Keep Buying by Nick Maggiulli (Author)

Puzzled about investing “Just Keep Buying” says dump the fancy schemes. Invest early, often, in a simple basket of stocks (index funds or any other bonds). Think of it like buying delicious treats on sale, every month, for 30 years. The market does the rest. You’ll have a sweet retirement pie, even if you’re not a finance expert.

We recommend this because

- Simple investing: No Wall Street jargon, just a simple, proven strategy.

- Pressure free growth: Let time and the market work for you, not against you.

- Wealth building giant: Start small, invest consistently, watch your wealth increase.

Ratings and Reviews:

The psychology of Money by Morgan Housel

“The Psychology of Money” forgets fancy methods and dives into how humans really relate to money. It’s all about the weird mindsets that make us protect, spend, invest, and sometimes mess up financially.

Think of it as 19 relatable stories with money lessons that sneak up and stick with you. No spreadsheets or waffle required. Buy it if you want to upgrade your money knowledge, laugh while learning, and ditch the pressure to keep up with everyone else’s wealth present.

Eventually, “The Psychology of Money” is not about making millions overnight, but about developing a healthy and supportive relationship with money that can contribute to a happier and more fulfilling life. So, if you’re ready to dump the financial stress and develop a smarter approach to your finances, this book is definitely worthwhile for you.

Ratings and Reviews:

Conclusion

These top 5 Best Books on Personal Finance, like seasoned financial guides, offer unique paths to wealth. “The Richest Man in Babylon” whispers timeless wisdom, “Rich Dad, Poor Dad” challenges convention, “The Intelligent Investor” builds a fortress of knowledge, “Just Keep Buying” whispers patience, and “The Psychology of Money” unlocks the secrets within.

Together, they invent a wall-hanging of financial freedom. So, choose your guide, embark on your journey, and let wealth bloom in your wake. All these best books on personal finance you can buy on amazon.

FAQs

how to buy best books on personal financ in USA?

Depends on what you’re buying! Online stores, major retailers, specialty shops… endless options.

best books on personal finance for beginners?

“I Will Teach You to Be Rich” (Ramit Sethi), “Get Good with Money” (Tiffany Aliche). Both practical and engaging.

Which finance book should I read first?

The Psychology of Money” (Morgan Housel). Understand your relationship with money before diving into tactics.

What is the best budget rule?

50/30/20: 50% needs, 30% wants, 20% savings/debt. Simple and flexible.

1 comment

I wholeheartedly endorse every idea you’ve put forth in your post. While they are undeniably persuasive and likely to be successful, the posts themselves are a bit too brief for novice readers. Could you kindly extend them slightly in the future? Thank you for the informative post.